Top 5 Currency Pairs Beginners Should Trade First

Estimated reading time: 3 minutes

Table of contents

Stepping into Forex trading can feel overwhelming at first, charts, currencies, and data everywhere! But picking the right pairs can simplify your journey.

The best currency pairs for beginners are those with high liquidity, tight spreads, and stable yet tradable price movements. You’ll learn faster, trade cheaper, and manage risk easier.

In this guide, we’ll cover which pairs to start with, why they work well for beginners, and how to choose wisely.

Why Choose Major Currency Pairs?

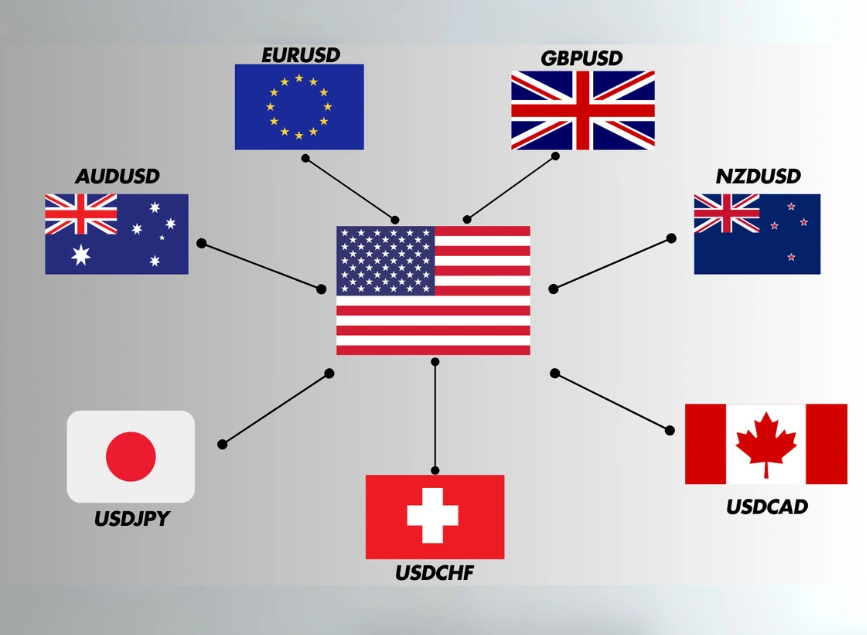

Major pairs always include the US dollar and another strong global currency like the euro, yen, pound, or franc. These pairs dominate Forex volume—up to 85% of all daily trades—giving you massive liquidity, tight spreads, and reliable price behavior.

Beginners benefit from:

- Easier entries and exits

- Predictable reactions to economic news

- Lower trading costs

Top 5 Beginner-Friendly Currency Pairs

📌 EUR/USD (Euro/US Dollar)

- The most traded pair globally—about 22–28% of daily volume.

- Offers low spreads, high liquidity, and predictable, smooth movements.

- Responds cleanly to ECB and Fed announcements.

🌍USD/JPY (US Dollar/Japanese Yen)

- Highly liquid and historically stable.

- Influenced by US and Japanese economic data, offering clear price trends.

- Safe-haven behavior makes it less volatile during risk-off times.

🌍GBP/USD (British Pound/US Dollar)

- Also known as “cable”—offers good trading volume and slightly higher volatility than EUR/USD.

- Good for gaining experience with price swings and economic event timing.

📌 AUD/USD (Australian Dollar/US Dollar)

- Commodity-influenced pair—sensitive to gold and commodity prices.

- Solid liquidity, moderate volatility, and clear correlation to global trends.

🌍 USD/CAD (US Dollar/Canadian Dollar)

- Canada’s oil-export-driven economy means this pair tracks oil price trends.

- Good liquidity and predictable behavior, tighter spreads too.

Why These Pairs Work for Beginners

- ✅ High liquidity, low spreads help minimize trading costs.

- ✅ Stable and tradable without extreme swings.

- ✅ Well-understood fundamentals: data releases are consistent and easy to follow.

- ✅ Easier backtesting and strategy building thanks to reliable price patterns and technical zones.

📊 Summary Table: Major Forex Pairs for Beginners

| Currency Pair | Reason to Start With It | Volatility Level |

|---|---|---|

| EUR/USD | Most liquid, tight spreads, predictable moves | Low–Medium |

| USD/JPY | Stable trends, influenced by yen safe-haven flow | Low–Medium |

| GBP/USD | More volatility, good for learning moves | Medium |

| AUD/USD | Commodity exposure, steady correlations | Medium |

| USD/CAD | Oil-linked behavior, solid liquidity | Medium |

Pro Tips for Beginner Traders

- Start with 1–2 pairs: focus deeply on behavior and patterns.

- Follow major trading sessions: London–New York overlap is best for EUR/USD and GBP/USD.

- Use an economic calendar: track announcements like interest rates, jobs, inflation for these economies.

- Avoid exotic pairs early, they have low liquidity, high spreads, and unpredictable behavior.

Read More:What Is a Wish Pair? Understanding the Concept in Forex Trading

✅ Summary

Starting with the best currency pairs gives beginners a solid trading foundation. Focus on EUR/USD, USD/JPY, GBP/USD, AUD/USD, or USD/CAD to trade smarter, reduce risk, and build confidence.

👉 Your next step: pick one or two pairs, observe their charts for a week, and note how they respond to news and sessions. Share your favorite pair or first observations in the comments!

❓ FAQ

1. Why not start with exotic or cross pairs?

They have lower liquidity, wider spreads, and can spike unpredictably, risky for new traders.

2. Can I trade more than two pairs as a beginner?

Experts suggest mastering 1 pair first, then gradually add one more for variety and backup.

3. When should I trade these pairs?

Swap first-time experiments into London–New York session overlap (08:00–12:00 EST).

4. What affects spread and liquidity?

Trading volume, broker fees, and market events, majors generally offer the best conditions.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *