The MACD Indicator: A Key Tool for Technical Analysis

The MACD (Moving Average Convergence Divergence) is one of the most widely used indicators in technical analysis, favored for its ability to detect changes in market momentum, trend strength, and direction. Developed in the 1970s by Gerald Appel, the Moving Average Convergence Divergence has become an essential tool for traders around the world due to its simplicity, flexibility, and ability to quickly respond to price changes. Its efficiency makes it particularly valuable in volatile markets.

What is the MACD Indicator?

MACD stands for Moving Average Convergence Divergence, a term that refers to the relationship between two moving averages of an asset’s price. The indicator helps traders identify changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

Due to its responsiveness to price changes, the Moving Average Convergence Divergence is considered one of the best indicators for use in volatile markets such as stocks, Forex, and cryptocurrencies. Let’s dive deeper into how the MACD works and how traders can leverage it to identify trading opportunities.

How Does the MACD Work?

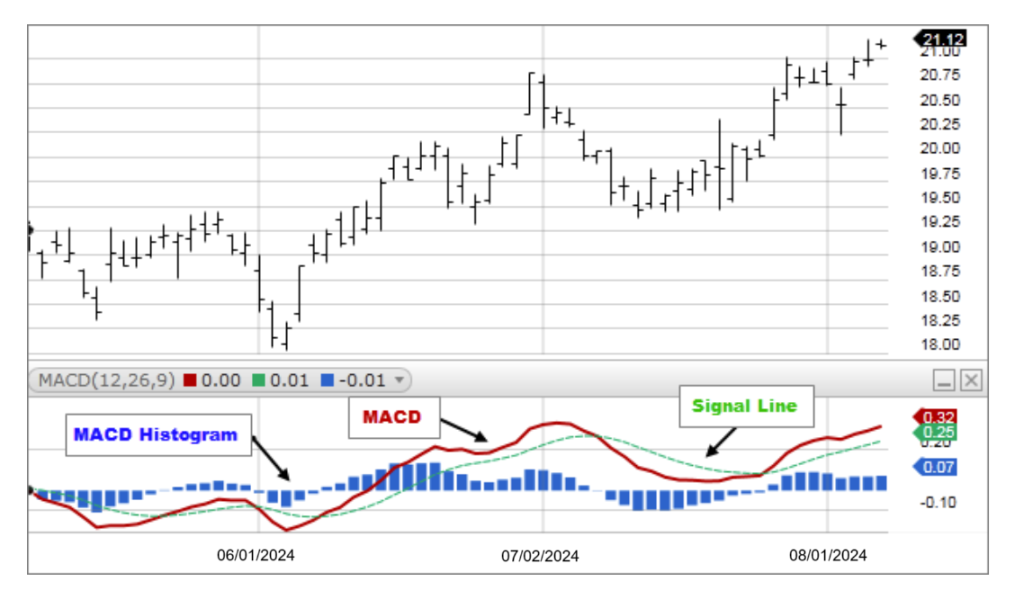

The MACD is typically displayed below the price chart and consists of three main components:

- MACD Line

- Signal Line

- Histogram

MACD Line

The MACD Line is the difference between the 12-day exponential moving average (EMA) and the 26-day EMA. It is used to identify the direction of the trend. When the Moving Average Convergence Divergence Line crosses above or below the Signal Line, it signals potential changes in market trends.

The MACD Line is generally displayed in blue on charts.

Formula:

MACD Line = EMA(12) − EMA(26)

Signal Line

The Signal Line is a 9-day EMA of the Moving Average Convergence Divergence Line. This line helps traders spot trend reversals. A crossover of the MACD Line above the Signal Line typically signals a potential buy opportunity, while a crossover below the Signal Line signals a potential sell.

The Signal Line is usually shown in red.

Histogram

The Histogram represents the difference between the MACD Line and the Signal Line. It visually indicates the strength of the price momentum. As the price momentum increases, the bars on the histogram get larger; as it decreases, the bars shrink.

How to Use the MACD Indicator

The MACD is a versatile tool that helps traders identify trend changes and find entry and exit points. Let’s look at the most common methods of using the Moving Average Convergence Divergence in technical analysis.

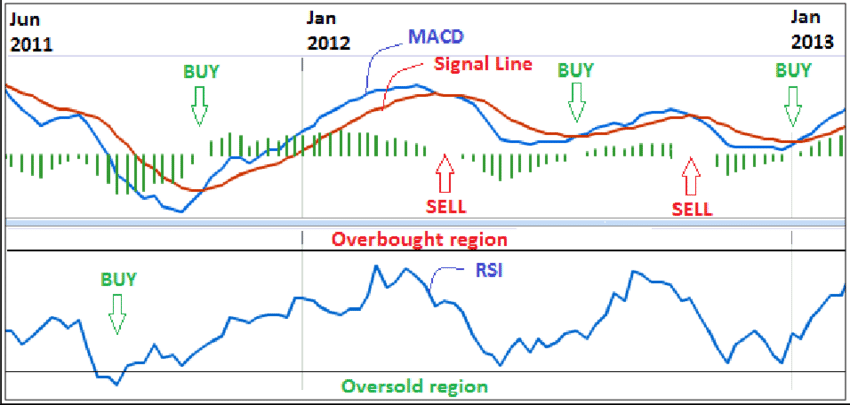

1. MACD and Signal Line Crossovers

One of the most straightforward and widely used strategies is to watch for crossovers between the MACD Line and the Signal Line. These crossovers serve as buy and sell signals:

- Buy Signal: When the MACD Line crosses above the Signal Line, it suggests a potential upward trend, signaling a buy entry point.

- Sell Signal: When the Moving Average Convergence Divergence Line crosses below the Signal Line, it indicates the potential start of a downward trend, signaling a sell or exit point.

2. MACD Crossing the Zero Line

The zero line is an important threshold in the MACD chart. It helps traders identify shifts in market trends:

- Bullish Trend: If the MACD Line crosses above the zero line, it suggests that the short-term price average is now higher than the long-term price average, signaling an upward momentum and a potential bullish trend.

- Bearish Trend: If the MACD Line crosses below the zero line, it indicates that the short-term price average is now below the long-term average, signaling a potential bearish trend.

3. Divergences

Divergences between the MACD Line and price movements can signal a potential reversal in the trend. There are two types of divergences:

- Bullish Divergence: If the price of an asset is falling but the MACD Line is rising, it suggests that the downtrend may be losing strength, potentially leading to a price reversal upward. Traders may consider this a buying opportunity.

- Bearish Divergence: If the price of an asset is rising but the Moving Average Convergence Divergence Line is falling, it suggests that the uptrend may be weakening, signaling a potential price reversal downward. Traders may look for selling opportunities in this scenario.

Advantages and Disadvantages of the MACD Indicator

Like any technical tool, the MACD has both strengths and weaknesses. Understanding these can help traders use it more effectively.

Strengths of the MACD:

- Flexibility: The MACD can be applied to various financial markets, including stocks, Forex, and cryptocurrencies.

- Trend Detection: Its combination of moving averages allows it to effectively identify trend changes and momentum shifts, making it a powerful tool for trend-following traders.

Weaknesses of the MACD:

- Signal Delay: As a moving average-based indicator, the MACD may lag behind price action, especially in volatile markets, which can result in delayed signals.

- False Signals: In unstable or sideways markets, the MACD may produce false signals that can mislead traders.

Read More: The Forex Market: A Comprehensive and Practical Guide

Common Mistakes When Using the MACD

To get the most out of the Moving Average Convergence Divergence, traders should avoid some common mistakes:

1. Ignoring Divergence Signals

One common mistake is overlooking divergence signals between the MACD and price action. These signals often indicate upcoming trend changes, and ignoring them can result in missed opportunities or incorrect trades.

Solution: Always pay attention to divergences and treat them as warnings of potential trend changes. Combining the MACD with other indicators can help confirm these signals.

2. Neglecting Risk Management

Some traders enter trades based on MACD signals without considering risk management strategies. This can result in significant losses.

Solution: Always set clear risk management rules before entering a trade, including stop-loss levels and trade sizes, to minimize the risk of large losses.

3. Reacting Too Quickly to Signals

Traders sometimes rush into trades immediately after receiving a buy or sell signal without waiting for confirmation. This can lead to entering a trade at the wrong time.

Solution: Always confirm Moving Average Convergence Divergence signals with other indicators such as the RSI, support and resistance levels, or chart patterns to ensure more accurate decision-making.

4. Ignoring Overall Market Conditions

Using the MACD without considering the broader market environment can lead to poor decisions. For example, in volatile markets, the Moving Average Convergence Divergence may produce many false signals.

Solution: Always assess overall market conditions before relying solely on the MACD. Use it as part of a comprehensive analysis rather than in isolation.

Conclusion

The MACD is a highly effective tool for identifying trend changes and providing buy and sell signals. However, to use it to its full potential, traders should combine it with other technical tools and focus on proper risk management. By understanding the strengths and weaknesses of the MACD and avoiding common mistakes, traders can improve their decision-making process and increase their chances of success in the markets.

Share

Hot topics

Federal Reserve’s Challenges to Trump’s New Policies

As the Federal Reserve Open Market Committee (FOMC) prepares for its upcoming meeting, all eyes are on how the Fed will respond to Donald Trump’s latest economic policies. With the...

Read more

Submit comment

Your email address will not be published. Required fields are marked *