What is the Relative Strength Index (RSI)?

Estimated reading time: 5 minutes

Table of contents

The Relative Strength Index (RSI) is one of the most widely used and powerful technical indicators, valuable for both novice and experienced traders. Technical indicators play a crucial role in market analysis, enabling traders to identify trends and make strategic decisions about entry and exit points. Among these tools, the RSI stands out as an essential resource for understanding market conditions and facilitating smarter trading decisions.

History of the Relative Strength Index

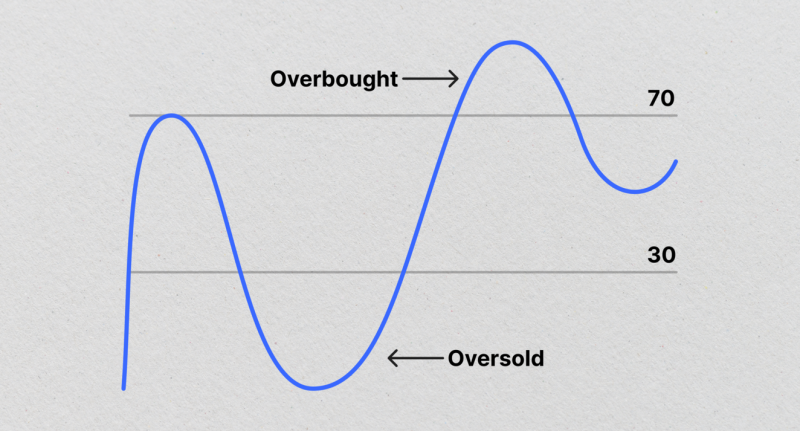

The RSI is a momentum-based indicator that measures the speed and magnitude of price changes in the market. Introduced by J. Welles Wilder in 1978, RSI helps traders identify overbought and oversold conditions. It operates on a scale from 0 to 100, where:

- Above 70: The market is considered overbought, suggesting a potential price pullback.

- Below 30: The market is considered oversold, indicating a potential price rebound.

These thresholds serve as indicators for potential reversals in market trends.

How to Calculate RSI

The RSI is calculated using the following formula:

RSI = 100 – [100 ÷ ( 1 + (Average Gain During Up Periods ÷ Average Loss During Down Periods ))]

Where RS is the ratio of the average gains to the average losses over a specified period (commonly 14 days). Here’s a step-by-step breakdown of how RSI is calculated:

- Average Gain: Sum of all price increases over a given period divided by the number of periods with gains.

- Average Loss: Sum of all price decreases over a given period divided by the number of periods with losses.

- RS (Relative Strength) is computed as the ratio of the average gains to the average losses.

- Finally, the RSI value is derived using the formula above, where a higher RSI indicates more upward momentum and a lower RSI indicates potential downward momentum.

Applications of RSI

The Relative Strength Index is a powerful tool for detecting overbought or oversold conditions in the market:

- Above 70: Indicates a possible overbought condition, suggesting the market may be due for a price correction.

- Below 30: Suggests an oversold condition, indicating a potential for a price rebound.

Moreover, RSI can help identify support and resistance levels as the indicator tends to oscillate near these levels, providing valuable signals for potential breakout or reversal points.

RSI Divergences

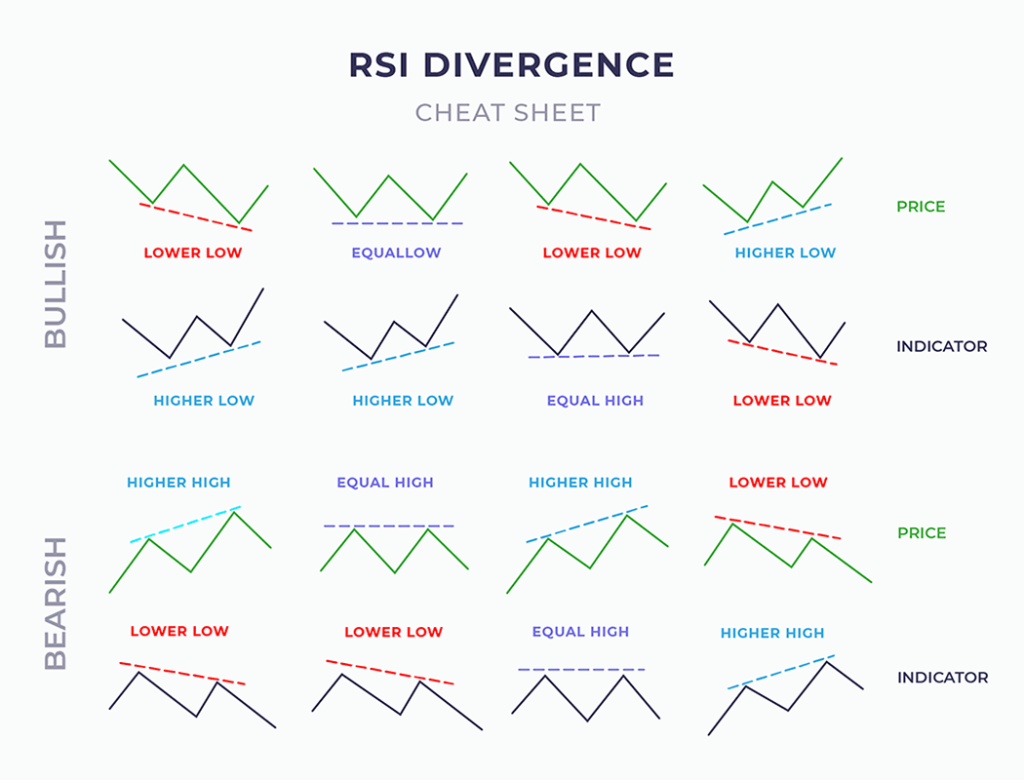

Divergences in RSI are crucial signals that can indicate potential changes in market trends. There are two primary types of divergences:

Regular Divergences

- Bullish Regular Divergence: Occurs when the price forms lower lows while RSI forms higher lows. This divergence can signal a potential upward reversal in the trend.

- Bearish Regular Divergence: Happens when the price forms higher highs while RSI forms lower highs. This divergence may suggest a potential downward reversal.

Hidden Divergences

- Bullish Hidden Divergence: Occurs when the price forms higher lows while RSI shows lower lows, which can be a sign of the continuation of an uptrend.

- Bearish Hidden Divergence: Happens when the price forms lower highs while RSI forms higher highs, indicating the persistence of a downtrend.

These divergences are critical for traders to monitor as they provide early warning signals of potential market reversals or trend continuations.

Read More: Understanding Trendlines: A Comprehensive Guide for Traders

Common Mistakes in RSI and How to Avoid Them

1. Ignoring Divergences

One of the most common mistakes traders make is overlooking the divergences between price and RSI. Divergences often act as early signals of potential market reversals.

Solution: Always pay attention to divergences and treat them as alerts for a deeper market analysis. Combining RSI with other indicators can help confirm these signals.

2. Overtrading

Overreliance on RSI signals without considering other factors can lead to overtrading, resulting in financial losses.

Solution: Utilize The Relative Strength Index in conjunction with other technical tools such as moving averages or MACD, and maintain a disciplined trading strategy. A structured trading plan helps mitigate impulsive decisions based solely on RSI.

3. Neglecting Market Context

RSI may generate false signals during volatile or range-bound markets.

Solution: Always consider the broader market context, including economic factors and longer-term trends, before acting on RSI signals.

4. Emotional Trading

Many traders make decisions based on emotions rather than a predefined trading strategy. This can result in making decisions that are not aligned with the trader’s goals.

Solution: Maintain a disciplined approach by following your trading strategy and using The Relative Strength Index as one of many tools. Avoid being swayed by emotional impulses and stick to your trading plan.

Final Thoughts

The Relative Strength Index is a valuable tool for traders looking to improve their decision-making and manage risk effectively. While RSI provides useful insights into market momentum, its success depends on a trader’s knowledge, discipline, and emotional management. Combining RSI with other technical indicators and considering the overall market context can enhance trading strategies and lead to better outcomes. Remember, there is no single indicator that guarantees success. A well-rounded analysis approach is crucial for making informed trading decisions.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *