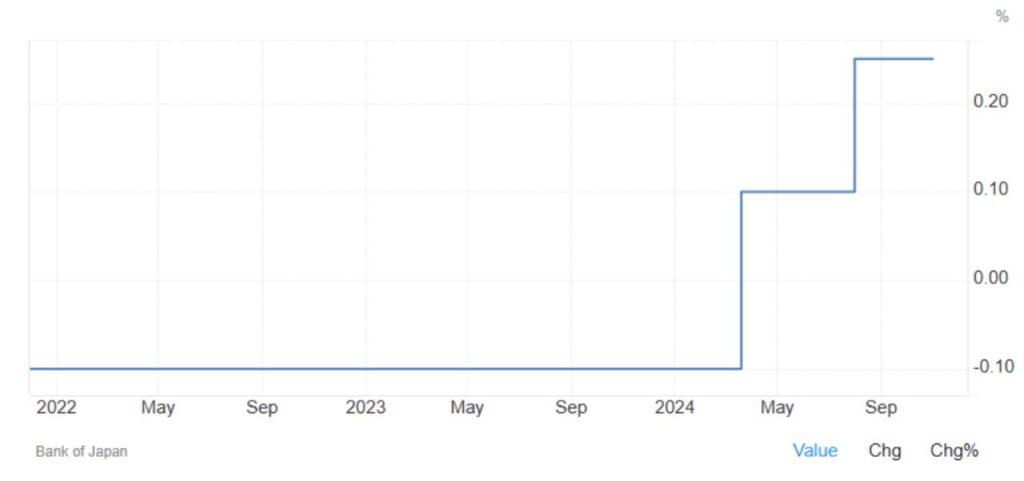

Japan Interest Rate

The Bank of Japan (BoJ) has chosen to keep its key short-term interest rate unchanged at 0.25% during its October meeting, marking the highest level since 2008 and aligning with market expectations. This decision comes as Japan’s political landscape shifts following recent elections, and as the world watches the upcoming U.S. presidential election.

Governor Ueda Highlights Global Economic Risks

Governor Kazuo Ueda cited a volatile global economic environment, signaling that the central bank remains cautious. He emphasized that the BoJ has time to assess risk factors after rate hikes implemented in March and July, underscoring the need for careful analysis before any further rate adjustments. This approach aims to balance domestic stability with a growing focus on external risks.

Commitment to Future Rate Increases if Conditions Align

The BoJ policy board reiterated its commitment to raising rates further if economic and price trends align with its forecasts. The bank is closely watching economic indicators to ensure that any future adjustments are data-driven, balancing inflation control with sustainable growth. This stance underscores the BoJ’s cautious optimism and readiness to respond as conditions evolve.

Inflation and Growth Forecasts Remain Unchanged

In its quarterly outlook, the BoJ held steady on its core inflation forecast, expecting it to reach 2.5% in FY 2024 and settle around 1.9% for both FY 2025 and FY 2026. The bank also maintained its GDP growth projection at 0.6% for 2024, with anticipated growth rates of 1.1% in FY 2025 and 1.0% in FY 2026. These forecasts reflect the bank’s steady approach to economic policy amid a complex global environment.

Share

Hot topics

Federal Reserve’s Challenges to Trump’s New Policies

As the Federal Reserve Open Market Committee (FOMC) prepares for its upcoming meeting, all eyes are on how the Fed will respond to Donald Trump’s latest economic policies. With the...

Read more

Submit comment

Your email address will not be published. Required fields are marked *