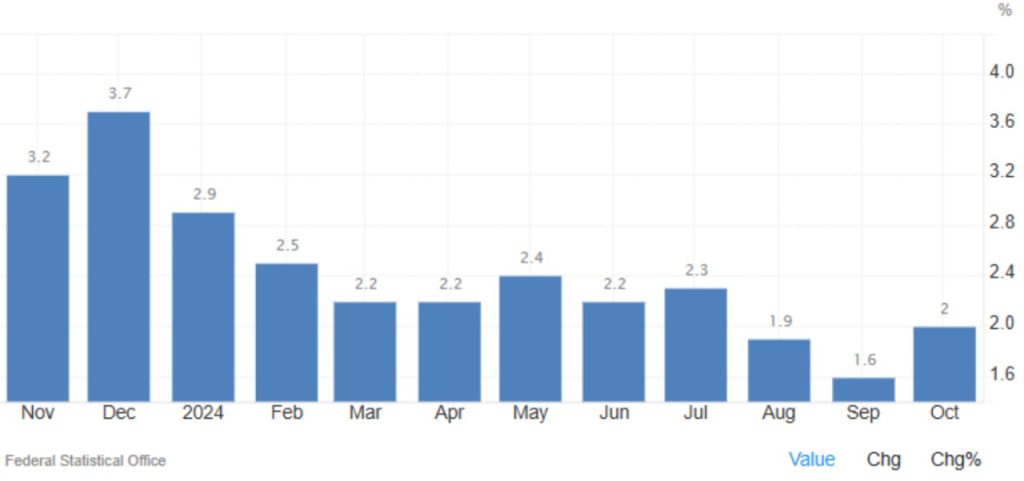

Germany Inflation Rate

Germany’s annual inflation rate experienced a notable increase in October 2024, rising to 2%, marking the highest rate in three months. This uptick follows a 3.5-year low of 1.6% in September and exceeds forecasts, which anticipated an inflation rate of 1.8%. The preliminary estimates indicate that the inflationary pressures in the economy are starting to intensify, leading to concerns among consumers and policymakers alike. As inflation impacts purchasing power, the increase in prices could have broader implications for the economic landscape.

Key Contributors to Price Increases

The rise in inflation was primarily driven by increases in services and food prices. Services saw a significant increase of 4%, compared to 3.8% in September, reflecting growing demand in sectors like hospitality and healthcare. Food prices also climbed, reaching a year-on-year increase of 2.3%, up from 1.6% the previous month. These rises in essential service and food costs may lead to heightened concerns among households, as they directly impact daily living expenses. In contrast, goods prices rebounded with a modest increase of 0.4% after experiencing a decline, indicating some stabilization in consumer goods costs.

Energy Costs and Month-on-Month Trends

Interestingly, energy costs fell less sharply in October, with a decrease of 5.5% compared to a more significant drop of 7.6% in September. This moderation in energy price reductions suggests that while overall energy costs are still declining, the pace has slowed, which could indicate a potential stabilization in the energy market. On a month-on-month basis, the Consumer Price Index (CPI) increased by 0.4% in October after remaining flat in September, reflecting an overall upward trend in prices that could signal the start of a more sustained inflationary period.

EU-Harmonized Inflation and Broader Implications

The EU-harmonized inflation rate for Germany also saw a rise, climbing to 2.4% year-on-year from 1.8%, with a monthly increase of 0.4% compared to a decrease of -0.1% in the previous month. This trend aligns with the broader economic environment across the European Union, where inflationary pressures are being felt across member states. The implications of rising inflation rates can be significant, potentially influencing monetary policy decisions by the European Central Bank (ECB) as they balance the need for economic growth against inflationary pressures. As consumers navigate higher prices, the government’s ability to address these concerns effectively will be crucial in maintaining economic stability and fostering consumer confidence moving forward.

Share

Hot topics

Federal Reserve’s Challenges to Trump’s New Policies

As the Federal Reserve Open Market Committee (FOMC) prepares for its upcoming meeting, all eyes are on how the Fed will respond to Donald Trump’s latest economic policies. With the...

Read more

Submit comment

Your email address will not be published. Required fields are marked *