Canada’s Inflation Cools in March 2025: Relief at the Pump, but Food Costs Surge

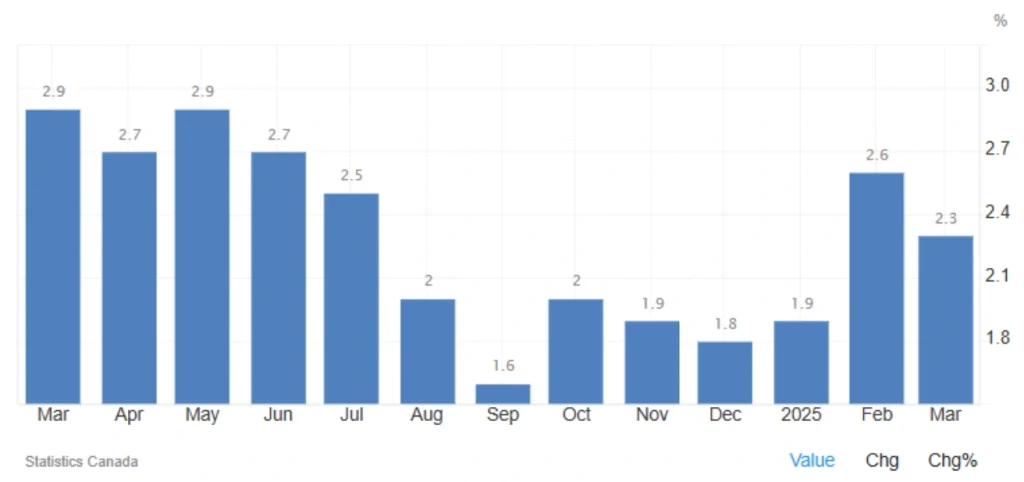

After months of pressure, Canada’s inflation rate is finally showing signs of easing. According to the latest data, annual inflation dropped to 2.3% in March 2025, down from February’s 8-month high of 2.6%. This cooling was sharper than both market expectations (2.6%) and the Bank of Canada’s forecast (2.5%), signaling a possible turning point for monetary policy.

But while inflation is declining overall, food prices are on a worrying upward trend—especially after temporary tax relief expired.

What Drove the Drop in March?

The BoC refers to this phase as “inflation normalization”, following a temporary inflation spike last month caused by GST and HST tax rebates that expired mid-February.

📉 Key Areas of Price Decline:

| Category | March 2025 | February 2025 | Reason |

|---|---|---|---|

| Gasoline Prices | -1.6% | +5.1% | Global oil price drop after OPEC+ announced production hikes |

| Transportation Costs | +1.2% | +3.0% | Slowing fuel-related costs |

| Mobile Services | -8.8% | -3.7% | Aggressive promotional campaigns by providers |

✅ These declines helped offset inflationary pressures in other sectors.

Food Inflation Heats Up

While energy and telecom prices cooled, food costs surged—especially in the restaurant sector, following the end of temporary tax cuts:

- Overall food inflation: ↑ 3.2% (from 1.3% in February)

- Restaurant meals: ↑ 3.2% (from -1.4% in February)

This sharp rebound suggests that households may continue to feel a pinch despite broader disinflation.

Read More: U.S. Stock Market: A Comprehensive Guide

📈 Monthly Inflation Snapshot

- Month-over-month CPI: +0.3%

This moderate rise shows a more stable price environment, aligning with the BoC’s target inflation range of 2–3%, with an ideal midpoint of 2%.

Why This Matters: Inflation & Monetary Policy

Inflation is a critical signal for Bank of Canada policy decisions. Lower inflation can open the door to:

- 🔻 Rate cuts or a pause in tightening cycles

- 💸 Improved affordability for consumers and businesses

- 📉 Relief in consumer-facing sectors like retail, transport, and housing

🔍 But Risks Remain:

- 🍽️ Food cost inflation may spill over into broader services inflation

- 💵 If the Canadian dollar weakens or wage growth accelerates, price pressures may return

Read More: What is CPI and How Does It Impact Financial Markets?

What’s Next for the BoC?

While this report brings optimism, the Bank of Canada must remain cautious. Future decisions will depend on:

- Core inflation trends

- Labor market strength

- Global commodity prices

With inflation nearing the BoC’s target, markets and households alike are hopeful—but not yet fully at ease.

Summary

✅ Positive Signs:

- Lower energy and telecom costs

- Headline inflation below forecasts

- Room for a more dovish BoC stance

⚠️ Lingering Concerns:

- Food inflation remains elevated

- Potential upward wage and currency pressures

The path to stable inflation continues, but vigilance remains key.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *