Reserve Bank of Australia Cuts Interest Rates

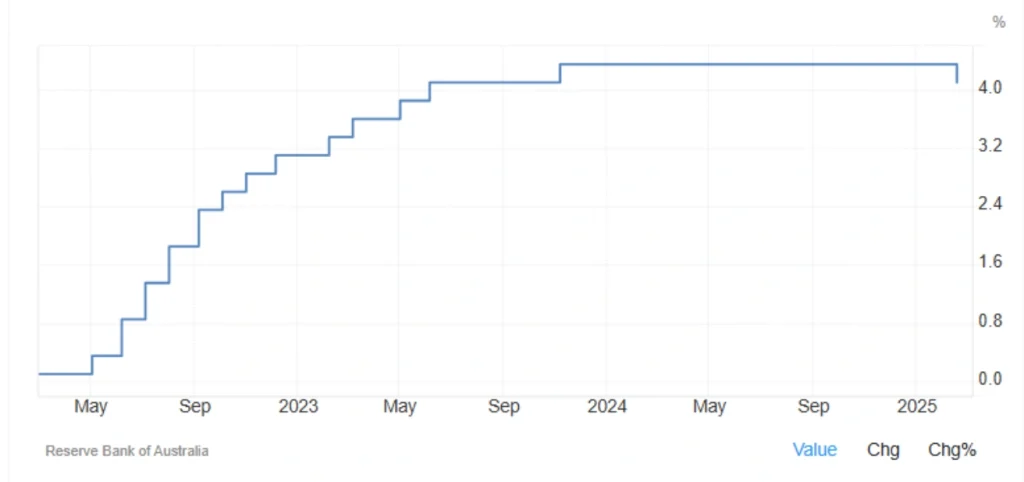

The Reserve Bank of Australia (RBA) reduced interest rates by 25 basis points to 4.1% in its February meeting. This marks the first rate cut since November 2020. The RBA’s decision was made with the aim of supporting economic growth, following a slowdown in core inflation.

Reasons for the Rate Cut

Core inflation has approached the central bank’s target range of 2-3%.

Economic growth and private demand recovery have been weaker than expected.

Global economic and geopolitical uncertainties continue to persist.

In its statement, the RBA noted that:

Higher interest rates in recent months have had an impact, and now reducing them could help balance demand and supply.

Australia’s economy still faces various risks, including slow growth in consumption and investment.

The central bank will be cautious about the future path of interest rates.

Additionally, the Exchange Settlement account interest rate was also reduced by 25 basis points to 4.0%.

Key Indicators to Watch

To understand the direction of monetary policy, it’s important to focus on certain indicators and phrases often used by the Reserve Bank of Australia (RBA). These provide insight into the bank’s future moves.

Phrases Indicating Future Policy Shifts

Watch for statements like “the need for caution in further rate cuts” or “inflation remains a concern.” These phrases suggest that the central bank is considering future policy actions but is also taking a careful approach to ensure economic stability.

Economic Conditions Analysis

The RBA’s stance on economic growth is another critical point. Is the central bank seeing strong growth, or are there signs of weakness? Additionally, concerns about employment and domestic demand can heavily influence their decisions, especially if there are signs of a slowing economy.

Summary: What’s Next for Australia’s Monetary Policy?

Looking ahead, the future of Australia’s interest rates depends heavily on economic performance. Let’s break down the most likely scenarios based on current trends.

The Possibility of a Monetary Easing Cycle

Recent signals from the RBA suggest that interest rate cuts in Australia could mark the start of a new period of monetary easing. However, the RBA remains cautious, making it clear that any future rate decisions will be guided by the latest economic data.

Further Cuts in the Second Half of 2025?

If economic growth continues to lag, the RBA might decide to implement additional interest rate cuts in the second half of 2025. A slow-growing economy could push the central bank to take action to stimulate growth and encourage spending.

Inflation Risk: A Possible Pause or Hike

On the other hand, if inflation makes a surprise resurgence, the RBA could reassess its policy stance. In this scenario, the central bank may pause future cuts or even reverse course and raise interest rates to curb inflation.

Conclusion: Monitoring Interest Rates for Smarter Financial Decisions

Interest rates remain one of the most crucial economic indicators for traders, investors, and policymakers alike. The direction of these rates can have a significant impact on markets, investment returns, and overall economic health.

By understanding how to analyze and interpret reports like the one from the RBA, you can make more informed, data-driven decisions in the financial markets. Stay alert to the economic conditions and policy signals—this is how you stay ahead of the game.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *