Germany’s Factory Orders in October 2024: A Mixed Performance

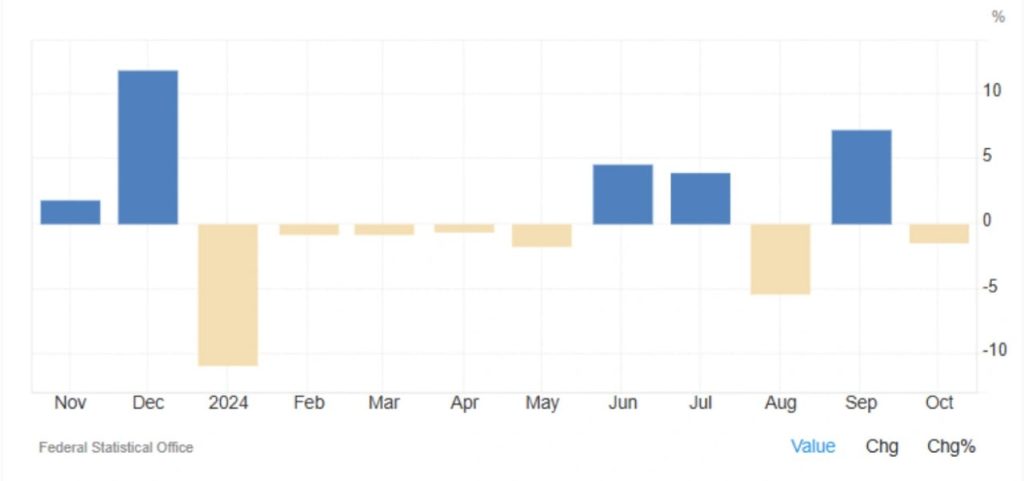

Germany’s factory orders fell by 1.5% month-over-month in October 2024, a smaller decline than market expectations of a 2.0% drop. This decrease followed an impressive upwardly revised 7.2% surge in September, the strongest growth since December 2023. While October’s contraction signals some slowing in industrial activity, the overall performance remains nuanced, with notable sectoral gains counterbalancing the declines. The report paints a picture of an industrial landscape facing both domestic challenges and international opportunities.

Declines in Key Sectors Weigh on Results

The most significant weakness in October’s data came from capital goods, where new orders fell by 3.6%. This category, which includes items like machinery and heavy equipment, is a bellwether for industrial investment. Within this group, machinery and equipment orders plummeted by 7.6%, highlighting the challenges facing Germany’s core manufacturing industries. Businesses appear cautious in their investment decisions, likely reflecting broader economic uncertainty, including rising borrowing costs and uneven global demand.

Automotive Orders Continue to Fall

The automotive sector, a cornerstone of Germany’s economy, also reported a decline, with orders dropping by 3.7%. This contraction reflects a mix of supply chain disruptions and softer demand in key export markets. The sector’s struggles are emblematic of broader issues in industrial manufacturing, where capital-intensive industries remain vulnerable to shifts in consumer demand and external economic pressures.

Bright Spots: Gains in Metals, Electronics, and Consumer Goods

Despite the broader decline, certain sectors experienced robust growth. Basic metals saw orders rise by 10.2%, reflecting increased demand from industries reliant on foundational materials. Similarly, computer, electronic, and optical products recorded an 8.0% increase in orders, underscoring the strength of technology-driven industries. These gains suggest that Germany’s industrial base is benefiting from global trends favoring technological advancement and infrastructure development.

Consumer and Intermediate Goods Buck the Trend

Orders for consumer goods rose by a solid 4.2%, indicating healthy demand in markets that cater directly to end-users. Intermediate goods, which serve as essential components for manufacturing, also saw a modest 0.9% increase in orders. These upticks highlight areas of stability within Germany’s industrial landscape, even as capital goods face headwinds.

Domestic Demand Weakens, International Orders Provide Support

One of the most concerning aspects of October’s report was the 5.3% drop in domestic orders. This significant contraction suggests a weakening in Germany’s internal market, likely influenced by high inflation, reduced consumer confidence, and tighter monetary conditions. Domestic demand is a critical pillar of Germany’s industrial activity, and its decline poses challenges for sustaining broader economic growth.

International Demand Offers Resilience

In contrast to the domestic market, foreign orders increased by 0.8%, providing a much-needed boost. Notably, demand from outside the Eurozone rose by an impressive 6.3%, reflecting strong interest in German products from key global markets such as the United States and Asia. However, orders from within the Eurozone dropped sharply by 7.6%, pointing to regional disparities in economic performance and demand. Excluding large orders, incoming orders edged up by 0.1%, signaling some underlying stability in international markets.

Quarterly Trends Point to Resilience

Despite the monthly decline, Germany’s industrial orders showed positive momentum over the longer term. In the three months from August to October, orders were 2.7% higher compared to the preceding three-month period. This improvement highlights the capacity of Germany’s industrial base to adapt to fluctuating global conditions. The gains in intermediate and consumer goods, coupled with strong international demand, suggest that the industrial sector has room for growth despite challenges in key areas like capital goods.

Looking Ahead: Germany’s Factory Orders

Germany’s factory orders data for October reflects an industrial sector at a crossroads. The declines in capital goods and domestic orders underscore significant challenges, including cautious investment behavior and softer internal demand. However, the gains in consumer goods, basic metals, and electronics, along with robust demand from non-Eurozone countries, provide a counterbalance to these headwinds.

Moving forward, the key to sustained growth will lie in bolstering domestic demand and capitalizing on global opportunities. Policymakers and industry leaders must address the structural challenges facing key sectors while fostering innovation and competitiveness in areas showing strength. With a focus on resilience and adaptability, Germany’s industrial sector can navigate the complex economic landscape and maintain its position as a global manufacturing powerhouse.

Share

Hot topics

Federal Reserve’s Challenges to Trump’s New Policies

As the Federal Reserve Open Market Committee (FOMC) prepares for its upcoming meeting, all eyes are on how the Fed will respond to Donald Trump’s latest economic policies. With the...

Read more

Submit comment

Your email address will not be published. Required fields are marked *