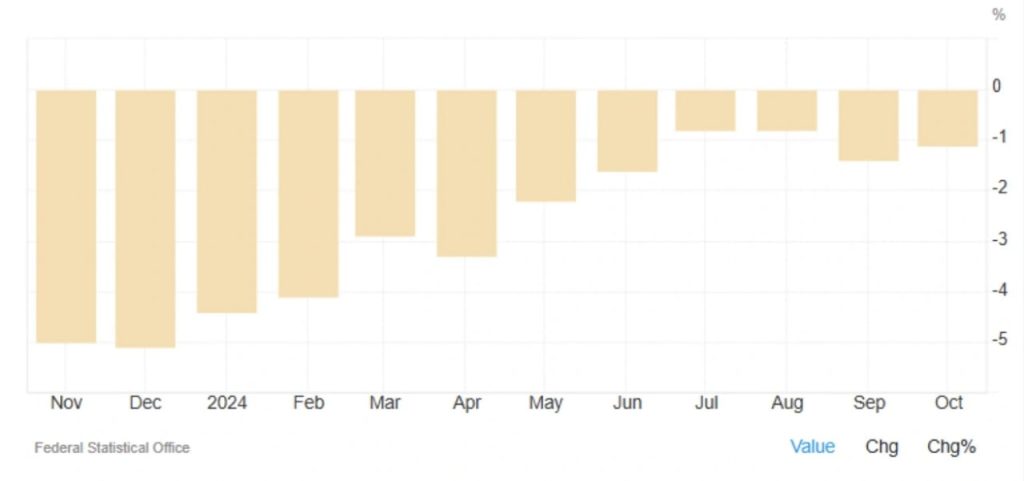

Germany’s Producer Prices Decline for 16th Consecutive Month in October 2024

Germany’s producer prices continued their downward trend in October 2024, falling by 1.1% year-on-year. This marked the 16th consecutive month of deflation in the producer price index, although the decline was slightly smaller than the 1.4% drop recorded in September. The October result was in line with market expectations and indicates a gradual easing of the downward pressure on prices, but the overall trend remains negative. The primary factor driving the ongoing deflation was a sharp drop in energy prices, which fell by 5.6% on an annual basis. Within the energy sector, costs for mineral oil products dropped by 12.9%, light heating oil saw a dramatic decline of 22.7%, and other energy sources such as fuels, natural gas, and electricity also experienced significant price reductions, falling by 12.1%, 10.1%, and 7.3%, respectively. These declines have been a key driver of the persistent weakness in Germany’s producer prices.

Energy Prices Dominate Deflation, But Other Sectors Show Price Growth

When excluding energy, Germany’s producer prices revealed a much more positive picture. Without the impact of energy, producer prices rose by 1.3% in October. This suggests that inflationary pressures were being felt more strongly in other sectors of the economy. The capital goods sector saw the most significant price increase, rising by 2.0%. This was mainly driven by higher costs for machinery (up 2.0%) and motor vehicles and parts (up 1.4%). Additionally, consumer goods saw an overall price increase of 1.9%, with durable goods rising by 0.9% and intermediate goods rising by 0.4%. These price increases in non-energy sectors indicate that while energy prices remain a major deflationary force, there is some inflationary pressure building in other parts of the economy, particularly in goods that are critical to production and consumption.

Monthly Price Movements Suggest Stabilization in Producer Prices

On a monthly basis, Germany’s producer prices showed signs of stabilization, with a modest 0.2% increase in October. This marked a recovery from the 0.5% decline observed in September and aligned with market forecasts. The monthly rebound signals that while deflation remains a significant challenge, there are signs of price stabilization in the broader economy. The rise in October was primarily driven by price increases in capital goods and consumer goods, although the overall price index was still influenced by the ongoing declines in energy prices. The monthly uptick suggests that producer prices may be stabilizing at lower levels, and this could signal a period of more balanced inflationary pressures in the coming months.

Looking Ahead: Energy Prices Remain a Key Risk for Inflation

Looking forward, the trajectory of Germany’s producer prices will likely remain tied to energy price developments. With energy prices continuing to experience volatility due to global supply and demand factors, further fluctuations are expected to weigh heavily on the overall producer price index. While the recent slight rebound in non-energy prices is a positive sign, the overall trend will largely depend on how energy prices evolve in the coming months. If energy costs stabilize, there could be further price increases in sectors like capital goods and consumer products, particularly if demand for these goods continues to rise. However, if energy prices continue to decline, it could prolong the current deflationary pressures on Germany’s producer prices.

As the German economy navigates these pressures, the ongoing changes in producer prices will be an important indicator of broader economic trends. If deflation persists, it may signal challenges for economic growth, especially in sectors heavily reliant on energy, such as manufacturing and transportation. On the other hand, any signs of sustained price increases in non-energy sectors could indicate a recovery in business activity, as companies adjust their pricing strategies in response to rising demand. For now, all eyes will be on the energy markets, as they remain the most influential factor in shaping the future path of Germany’s producer price inflation.

Share

Hot topics

Federal Reserve’s Challenges to Trump’s New Policies

As the Federal Reserve Open Market Committee (FOMC) prepares for its upcoming meeting, all eyes are on how the Fed will respond to Donald Trump’s latest economic policies. With the...

Read more

Submit comment

Your email address will not be published. Required fields are marked *